Contemplating coverage?

Subscribe to receive our emails & get

$200 OFF!

Have questions?

Call us: (833) 544-8273

Written By Erin Easley

Senior citizens often search for ways to secure their retirement lifestyle and protect their most valuable investment—their home. As retirees settle into their golden years, they typically want to enjoy peace of mind without worrying about unexpected home repairs that can disrupt their fixed-income budgets.

Making smart investments in home protection becomes crucial during retirement. One effective way to safeguard your home investment is through a comprehensive home warranty, which provides coverage regardless of when you purchase it during homeownership.

Consider this scenario: dealing with a broken air conditioning system during a summer heatwave can be both financially devastating and dangerous for many seniors, especially those with health conditions sensitive to extreme temperatures.

There’s a reason Liberty Home Guard was rated the #1 Home Warranty Service by U.S. News and World Report for 2021, 2022, 2023, and 2024. Check out our services.

Learn MoreWhat is a home warranty? A home warranty serves as a protective shield against wear and tear damage, malfunctions, and unexpected breakdowns of your home’s essential appliances and systems. When your washing machine stops working or your HVAC system fails, the warranty provider coordinates with qualified contractors to resolve the issue, typically for a reasonable service fee.

This protection differs significantly from homeowner’s insurance, which primarily covers catastrophic events like natural disasters, theft, or fires. Unlike manufacturer warranties that cover individual items for limited periods, home warranties provide comprehensive coverage for multiple systems and appliances over extended timeframes.

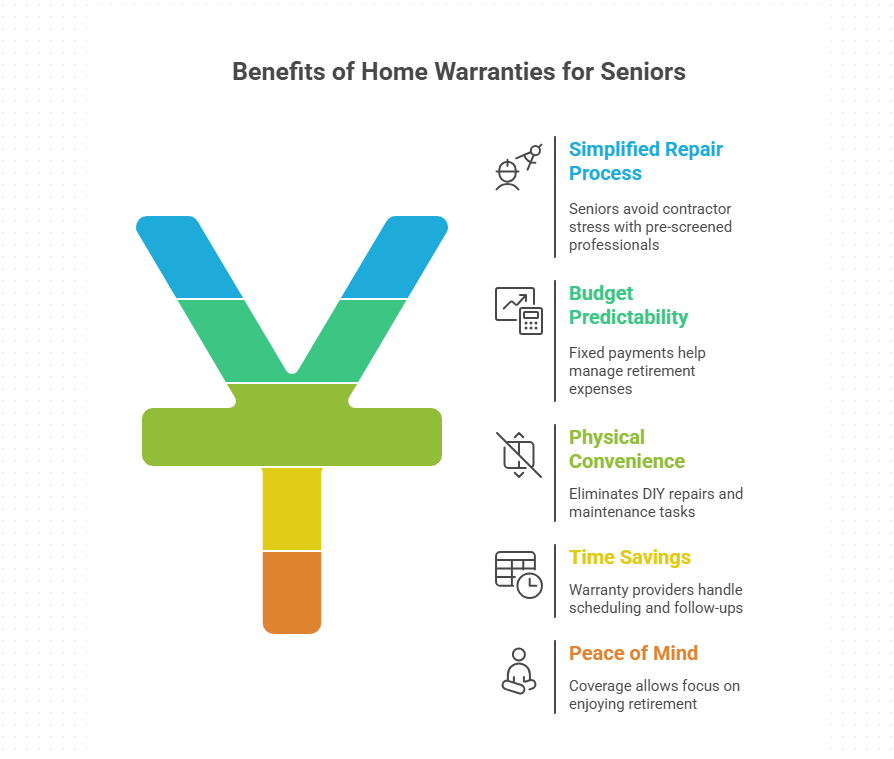

Home warranties offer unique advantages for older adults who may face physical limitations or fixed-income constraints:

Simplified Repair Process: Seniors avoid the stress of researching and vetting contractors, as warranty providers maintain networks of pre-screened professionals.

Budget Predictability: Fixed monthly or annual payments help seniors manage expenses on retirement incomes, avoiding surprise repair bills that can cost thousands.

Physical Convenience: Eliminates the need for seniors to perform DIY repairs or coordinate complex home maintenance tasks.

Time Savings: Warranty providers handle scheduling, follow-ups, and quality assurance, reducing the burden on homeowners.

Peace of Mind: Knowing that major home systems are covered allows seniors to focus on enjoying retirement rather than worrying about potential breakdowns.

Modern home warranty providers offer flexible pricing structures designed to accommodate various budgets and coverage needs. On average, a home warranty costs about $600 per year, though actual pricing depends on plan details and provider.

Typical costs include:

Annual Premiums: Range from $300 to $800 annually, depending on coverage level

Monthly Options: Available from many providers, typically $25 to $75 per month

Service Call Fees: Usually $75 to $125 per repair visit

Cost factors include:

The financial protection often proves invaluable—replacing a central air system can cost $5,000 to $8,000, while a home warranty service call typically costs under $100.

Research remains crucial when choosing a home warranty provider. Focus on these key evaluation criteria:

Company Reputation: Review customer feedback on independent platforms like Better Business Bureau, Trustpilot, and Google Reviews.

Coverage Details: Examine what’s included and excluded, paying special attention to age and condition limitations.

Service Network: Ensure the provider has qualified contractors in your area.

Response Times: Look for companies offering prompt service, ideally within 24-48 hours.

Contract Transparency: Avoid providers with unclear terms or excessive hidden fees.

Customization Options: Choose providers that allow you to select coverage based on your specific needs and budget.

There’s a reason Liberty Home Guard was rated the #1 Home Warranty

Service by U.S. News and World Report for 2021, 2022, 2023, and 2024. Check out our services.

Most home warranties do not cover pre-existing conditions or items that were already malfunctioning before coverage began. However, some providers offer coverage for older appliances and systems as long as they're currently functioning properly. It's essential to have systems inspected and working at the time of enrollment to ensure coverage eligibility.

Home warranty costs for seniors typically range from $300 to $600 annually for basic coverage, with comprehensive plans reaching $800 to $1,000 per year. Monthly payment options usually cost $25 to $75. Many providers offer senior discounts or fixed-income considerations, making coverage more affordable for retirees on limited budgets.

Most reputable home warranty providers prioritize emergency calls and aim to dispatch contractors within 24 to 48 hours for urgent issues like HVAC failures or plumbing emergencies. Non-emergency repairs typically receive service within 2 to 7 business days. Many companies offer expedited service for seniors or those with medical conditions requiring specific environmental controls.

Yes, home warranties are particularly beneficial for seniors with mobility limitations. Warranty providers handle all contractor coordination, scheduling, and follow-up communications. Many also ensure contractors are background-checked and insured, providing additional security for seniors who may be more vulnerable to service scams or unreliable repair workers.

Essential coverage for seniors should include HVAC systems (critical for health and comfort),water heaters, major kitchen appliances, washer/dryer, and electrical systems. Many seniors also benefit from coverage for garage door openers, doorbell systems, and any medical equipment-supporting electrical components. Prioritize systems that would be most expensive to replace or most critical to daily living and health maintenance.

Stay Ahead of Potential

Home Mishaps!

Subscribe to our Liberty Home Guard Newsletter and gain access to exclusive content that ensures your peace of mind.